Property Taxes

Property Taxes, or less commonly referred to as ad valorem taxes, are levied for all city operations and maintenance. This applies to all real estate and personal property unless exempted by law. Real property is considered as land and anything affixed to the land. Personal property, on the other hand, is anything not considered real property. This typically includes boats, and airplanes also inventory and fixtures used in conducting a business.

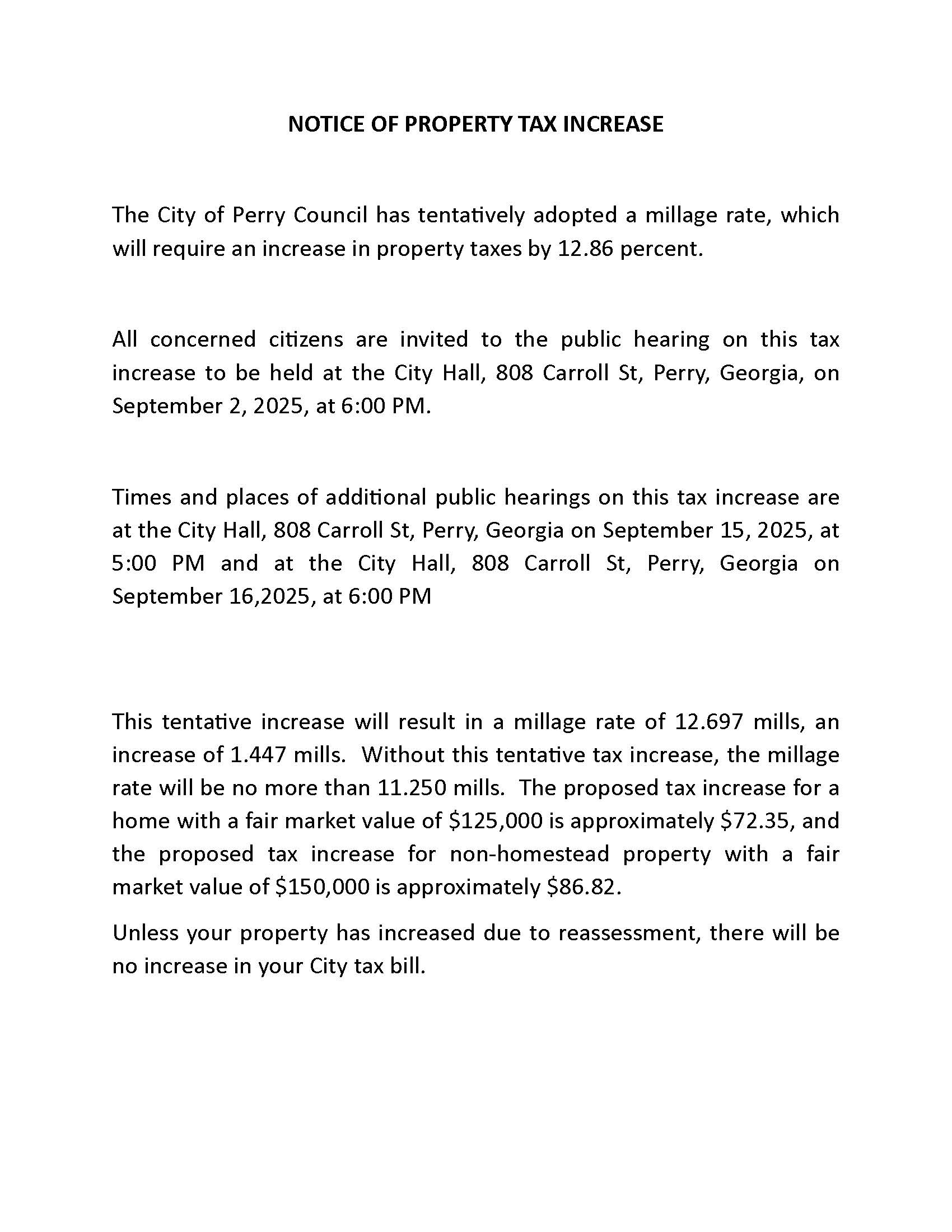

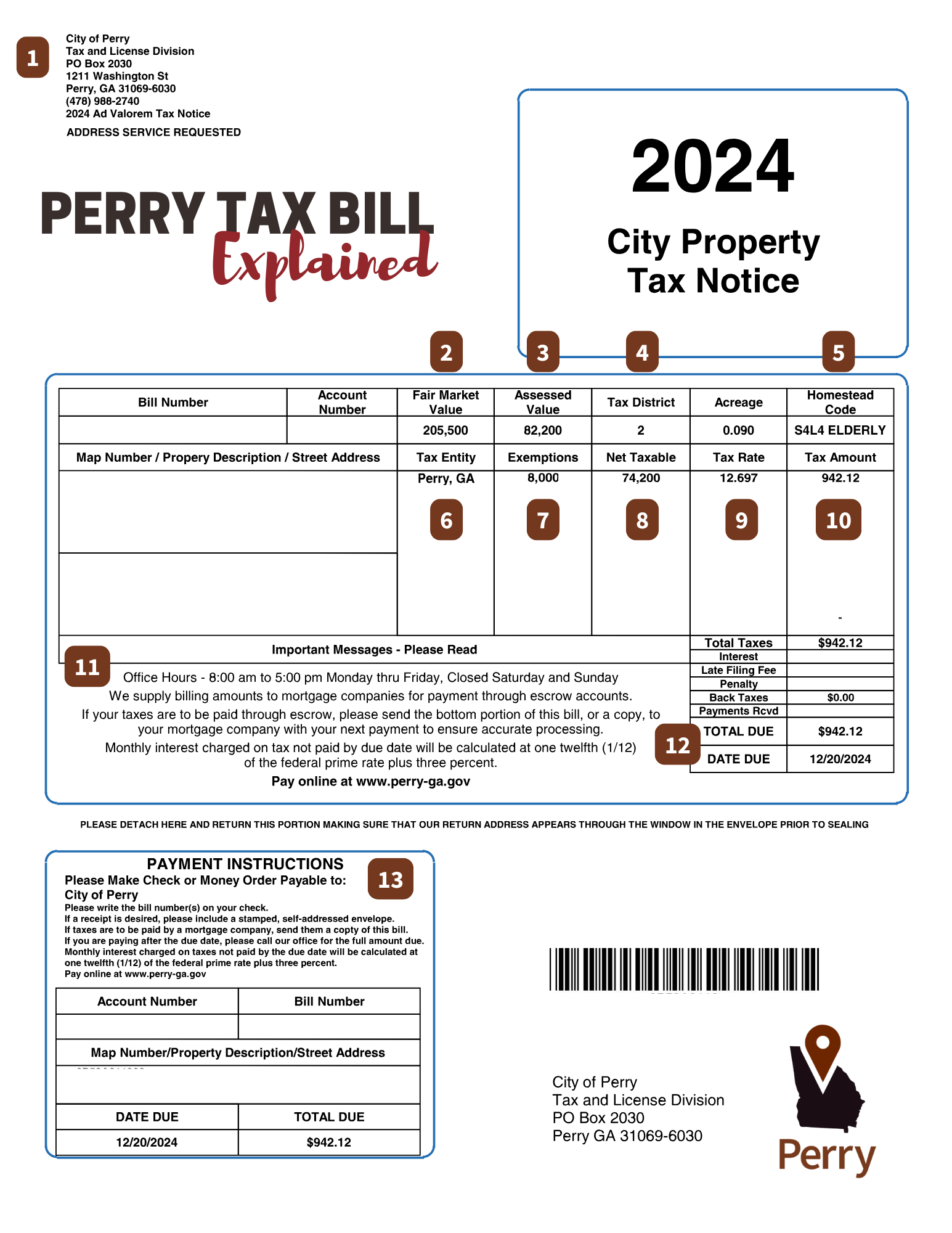

The property value is the full market value appraised by the assessors. All property in Georgia is taxed at an assessment rate of 40% of its full market value. The taxable value is then multiplied by the millage rate (1 mill = $1 tax per $1000.00 taxable value).

City taxes are mailed out no later than October 20th and are due no later than December 20th of each year. The city now offers the ability to view and/or pay property tax bills online. Payments are also accepted via mail to City of Perry P.O. Box 2030 Perry, Georgia 31069; or in-person on the first floor of City Hall located at 1211 Washington Street Perry, Georgia 31069.

If your taxes are included in your mortgage payments, please send a copy of the property tax bill to your mortgage company. The City of Perry does not send a duplicate copy to mortgage companies; the original bill is sent directly to the property owner.

The Houston County Tax Assessor conducts all tax assessments for the city. If you have any questions regarding the assessed value of your property you may contact the Houston County Tax Assessor’s office at (478) 218-4750 or visit their website by clicking here.

Delinquent Taxes

Interest on unpaid tax bills will be applied in accordance with Georgia Code §48-2-40. Monthly interest charged on taxes not paid by the due date will be calculated at one-twelfth (1/12) of the federal prime rate (per each year) plus three percent. The current interest rate is .708%.

Penalties on unpaid taxes will be applied in accordance with Georgia Code §48-2-44. A 5% penalty will be assessed if not paid by 120 days after the due date and an additional 5% will be added every 120 days with a maximum of 20%.